- Home

- About Us

- The Team / Contact Us

- Books and Resources

- Privacy Policy

- Nonprofit Employer of Choice Award

In the fall, Part 1 of this series took you on a quick tour of what we learned from the CAGP Foundation’s 2020 research—the study that sparked the Will Power campaign and challenged long-held assumptions about legacy giving in Canada.

Five years have passed. We’ve updated the research. And there’s a lot to talk about.

The full report lands early in the new year, but we’ve got some early insights to share now. Let’s begin with how Canadians write their Wills today, who they turn to for advice, and what that means for charitable gifts in Wills.

Do more Canadians have a Will?

Not really.

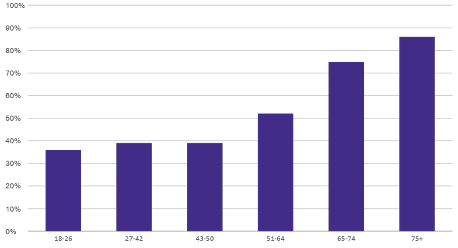

Much like in 2020, roughly half of the population 18+ have a Will. But when you look a little deeper you find that almost all Canadians 75+ years of age have a Will.

So, the problem isn’t whether or not people are writing Wills, eventually they do. The problem is that they’re not doing it when they should…the moment they hit 18!

There are disparities

One pattern that stood out across the research is a persistent gender gap in estate planning. Women are consistently less likely than men to have a Will — and the same is true for registered funds and life insurance policies. They also report engaging in estate planning activities less frequently.

There were also differences across the ethnic communities represented in the study. Black, Asian, and Indigenous respondents were all less likely to have a Will, while South Asian respondents were more likely.

We can’t say why these gaps exist, only that they do, and that they matter for how we move forward with estate planning in Canada.

How are Canadians writing their Wills?

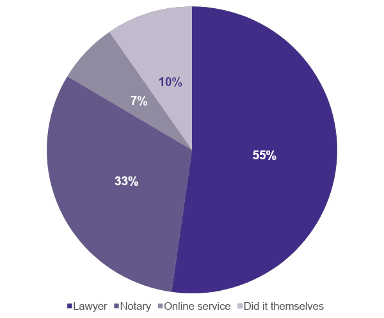

Most people still rely on lawyers and notaries. Legal professionals remain the dominant choice for Will writing across age, income, language, and gender.

Are they being encouraged to consider including a charity in their estate plans? Is the conversation even broached? About half say no…but that’s actually an improvement over 2020.

There have, however, been some new developments since 2020. More online Will services have popped onto the scene. Although they account for a small share of how Canadians write their Wills, those who use them are more likely to say they were prompted about charity.

Estate planning: the unsung hero of legacy giving

If Will writing is the moment everything becomes official, estate planning is the moment when people are making their choices. This new research makes one thing very clear: if organizations want more charitable bequests, they need to focus in on estate planning.

Most Canadians are doing at least some form of estate planning, a third going deep into the finances and taxes of it all.

The good news? Far more financial advisors are having the conversation with clients about estate planning and charitable giving than ever before!

Canadians under 50 years of age seem to be especially open to it.

What’s coming up?

If Part 1 of this WILL POWER update reminded us where we came from, Part 2 shows us the groundwork that shapes every charitable bequest: Will writing, estate planning, and the conversations that guide them.

But the big reveal is still ahead.

In Part 3, we’ll explore who’s thinking about legacy giving, what’s driving them, and the plans they’ve shared. Stay tuned.

Laurie Fox has been a die-hard charity sector professional for two decades. Her journey in planned giving started at Toronto General & Western Hospital Foundation and then Plan International Canada. It was there that Laurie discovered the power of strategic giving to turn the ordinary into the extraordinary; and its potential to help meet some of society's greatest needs. Since 2018, Laurie has been working with CAGP on the Will Power campaign - Canada's biggest effort to make leaving a gift in your Will a social norm. You can learn more at www.willpower.ca